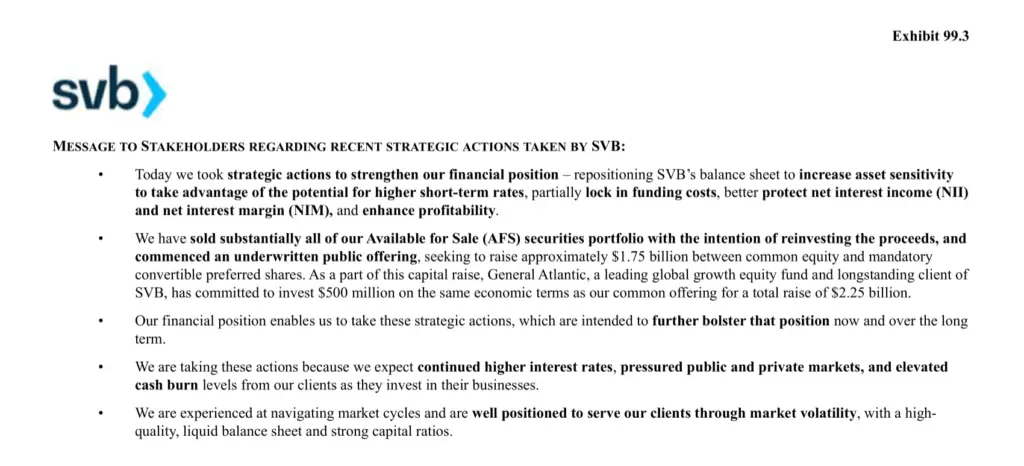

The FDIC (US Federal Deposit Insurance Corporation) took control as the receivership of Silicon Valley Bank after regulators in California shut down the failed bank when it failed to gather enough money to cover the cash letter from the Federal Reserve. A Federal Reserve cash letter is a list of “negotiable items”, primarily checks along with a list of all details (amounts, instructions for dispersal, etc). The bank run was triggered by venture capitalist firms encouraging withdrawals after Silicon Valley Bank’s former owner, SVB Financial Group released plans to sell $2.25 billion in common equity and preferred convertible stock as a means of recouping the expected $1.8 billion loss resulting from its Wednesday (03/08/23) sale of a $21 billion Available for Sale (AFS) bond portfolio which consisted of mostly US Treasury backed securities. The $21 billion AFS portfolio was primarily acquired by SVB during exceptionally low interest rates, which produced a significant disparity between the ones offered by Silicon Valley Bank’s portfolio and those currently offered by the Treasury Department in times of higher interest rates. SVB decided to sell at this AFS portfolio at a loss of $1.8 billion and use to cash to cover elevated cash burn levels.

Perks of being CEO: confidence and a head start for the run

It was not even two years ago (on May 20th, 2021 precisely) that Silicon Valley Bank’s CEO Greg Becker said in a Bloomberg TV interview :

“I always tell people I’m confident I’ve got the best bank CEO job in the world, and maybe one of the best CEO jobs,”

– Greg Becker (CEO of Silicon Valley Bank)

How things change with time

Apparently, that confidence fell towards the wayside when Becker and other execs began selling their shares in Silicon Valley Bank. Greg Becker sold 12,451 shares on 02/27/23 for $3.6 million per his SEC FORM 4. He acquired the identical number of shares via stock options at a price of $105.18 per share and sold the former shares at prices between $285.79 and $288.55 per share (almost triple the closing price on 03/10/23 when it went down to $106.04 per share). Others Silicon Valley Bank execs who have sold shares included CFO Daniel Beck (sold 2,000 shares for $575,000 on 03/01/23), and Chief Marketing Officer Michelle Draper (sold $20,070 worth of sell option on 01/24/23, and $263,440 worth of shares on 02/03/23). Chairman Beverly Kay Matthews was unique among top execs with her purchase of 1,000 shares for $232,061 on 01/05/23.

Neither was the confidence shared by deposit holders who were withdrawing a combined $42 billion during the unprecedented bank run, regardless of the bank being in “sound financial condition prior to March 9, 2023” (according to The State of California Dept. of Financial Protection and Innovation):

On March 8, 2023, the Bank announced a loss of approximately $1.8 billion from a sale of investments (U.S. treasuries and mortgage-backed securities). On March 8, 2023, the Bank’s holding company announced it was conducting a capital raise. Despite the bank being in sound financial condition prior to March 9, 2023, investors and depositors reacted by initiating withdrawals of $42 billion in deposits from the Bank on March 9, 2023, causing a run on the Bank. As of the close of business on March 9, the bank had a negative cash balance of approximately $958 million. Despite attempts from the Bank, with the assistance of regulators, to transfer collateral from various sources, the Bank did not meet its cash letter with the Federal Reserve. The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due, and the bank is now insolvent.

March 10th 2023 Filing

ORDER TAKING POSSESSION OF PROPERTY AND BUSINESS

State of California Department of Financial Protection and Innovation

Who were these investors and depositors, that collectively withdrew a total of $42 billion in one day? What or more importantly who influenced them to clean Silicon Valley Bank out of cash with massive withdrawals? Bloomberg reported that Union Square Ventures, Coatue Management, as well as Peter Theil’s Founders Fund urged investors to withdraw their money out of Silicon Valley Bank.

CNBC reported that in addition to the three above, Pear VC and Hoxton Ventures instructed their clients to withdraw from Silicon Valley Bank.

Self Fulfilling Prophecy?

Founders Fund withdrew millions from SVB, said the person, who asked not to be identified discussing private information. It joined other venture funds that took dramatic steps to limit exposure to the now-failed financial institution. Founders Fund also advised its portfolio companies that there was no downside to moving their money away from SVB, even if the risk was low.

Source: Bloomberg News

Were these “dramatic steps” necessary if “the risk was low”? Did it contribute to a self fulfilling prophecy of sorts?

Founders Fund acted in other ways to move its business away from SVB. On Thursday, as the bank was beginning to unravel, the firm started what’s known as a capital call. That’s a run-of-the-mill activity in the venture capital world, in which a VC firm asks its investors, or limited partners, to send it money in order to make investments in startups — the core function of most VC firms. It began by asking those backers to transfer the funds to accounts at SVB, as it has done for years, the person said.

But the firm learned that its limited partners were encountering issues using SVB services as they tried to transfer the funds — they weren’t immediately going through as expected, the person said.

Quickly, Founders Fund asked its investors to transfer the money to other banks instead. The fund acted to ensure that startup funding deals that were slated to close in the coming days were not delayed, the person said.

Source: Bloomberg News

Insiders, access to quick information, and those who don’t make it to the finish line in a bank run

The VC firms provided their investors with access to real-time crucial information that helped them make critical investment decisions at the expense of those less connected, which gave them an obvious advantage. What about those SVB account holders that weren’t privy to information concerning the difficulty in withdrawing millions out of Silicon Vally Bank? They were left to the fallout of a bank run, when their access to information lagged behind mega million Venture Capital backed bank runners.

Who had the most to gain from the aftermath of Silicon Valley Bank’s insolvency? Which competitors of SVB received deposits of cash directly tied to withdrawals from the Silicon Valley Bank run? At this point it is hard to say, but we know some of the banks mentioned by Venture Capital firms, as appropriate places for the cash recently withdrawn from SVB.

CNBC’s article stated:

“In light of the situation with Silicon Valley Bank that we are sure all of you are watching unfold, we wanted to reach out and recommend that you move any cash deposits you may have with SVB to another banking platform,” said Anna Nitschke, Pear’s chief financial officer, in an email to founders obtained by CNBC.

“In this market, a larger money center bank (think Citi Bank, JP Morgan Chase, Bank of America) is best suited, but in the interest of time, you might be able to open interim accounts faster with smaller banking platforms such as PacWest, Mercury, or First Republic Bank.”

What can be said about banks that have have higher loan to deposit ratios?

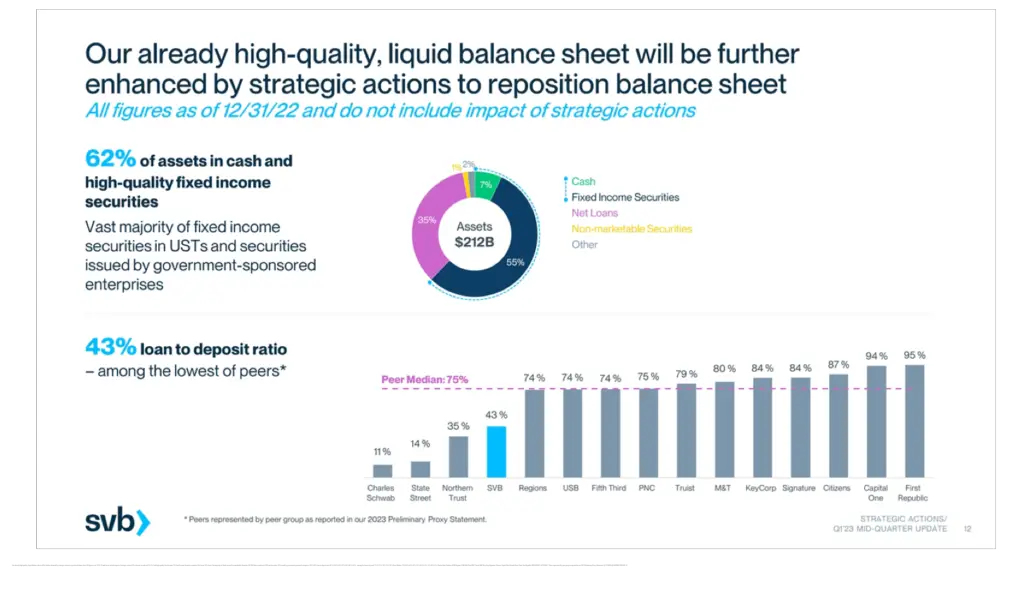

With a 43% loan to deposit ratio, Silicon Valley Bank’s ratio was allegedly lower than big names such as Regions(74%), USB (74%), PNC (75%), Capital One (94%) and First Republic (95%)

Ripple Effects

With SVB responsible for 44% of U.S. venture-backed tech and healthcare IPOs in 2022, there is no telling how many corporations could potentially be affected.

Roku (NYSE: ROKU) held $487 million of its cash with Silicon Valley Bank as uninsured assets, which constituted roughly 26% of Roku’s $1.9 billion total cash and cash equivalents (per its recent SEC filing):

The Company has total cash and cash equivalents of approximately $1.9 billion as of March 10, 2023. Approximately $487 million is held at SVB, which represents approximately 26% of the Company’s cash and cash equivalents balance as of March 10, 2023. Approximately $1.4 billion of the Company’s cash and cash equivalents is distributed across multiple large financial institutions. The Company’s deposits with SVB are largely uninsured. At this time, the Company does not know to what extent the Company will be able to recover its cash on deposit at SVB.

Notwithstanding the closure of SVB, the Company continues to believe that its existing cash and cash equivalents balance and cash flow from operations will be sufficient to meet its working capital, capital expenditures, and material cash requirements from known contractual obligations for the next twelve months and beyond.

ROKU SEC filing (March 10, 2023)

Treasury Secretary Janet Yellen explained during an interview with CBS’s “Face the Nation” that the Federal government isn’t planning on repeating the bank bailouts of 2008. Yellen assured the public that “We’re not going to do that again, but we are concerned about depositors, and we’re focused on trying to meet their needs.”

Besides the multitude of investors, there are many companies employing numerous people that may have difficulty meeting their payroll requirements since they held more than the FDIC insurable limit of $250,000.

More will be known in the next weeks to months about the greater extent of how Silicon Valley Bank insolvency and the bank run that immediately preceded it will impact the rest of the US economy and the employees that are susceptible to its effects.

More info:

Most recent Silicon Valley Bank SEC filing (March 08, 2023): click here

Order Taking Possession of Property and Business (regarding Silicon Valley Bank)

by the State of California Department of Financial Protection and Innovation: click here

Most recent ROKU SEC filing (March 10, 2023): click here

Share trades by SVB execs (SEC filings): click here

1 thought on “The Silicon Valley Bank Run: who made it to the finish line?”